Targets and Tactics: Overcoming Lower Return Expectations

As consensus grows on the prospect of lower asset class returns, investors are taking a fresh look at the potential consequences and solutions.

The potential consequences are stark:

- Public pension funds may not achieve their return targets, making it difficult to meet obligations without future budget sacrifices.

- Corporate defined benefit pension plans relying on excess returns over the liability growth rate to shore up deficits could be on the hook for additional contributions.

- Individual investors facing a steeper challenge in accumulating sufficient assets to live comfortably in retirement may have to lower living standards and save more.

As to potential solutions, investors could raise their expected returns by increasing allocations to riskier asset classes – but this would come with significantly higher risk and shortfall probability.

We believe a better and more efficient approach would be to replace current traditional physical equity exposures with synthetic equity exposure backed by long-duration bonds. This may enable investors to achieve increased long-term expected returns with lower incremental volatility.

TIMES ARE CHANGING

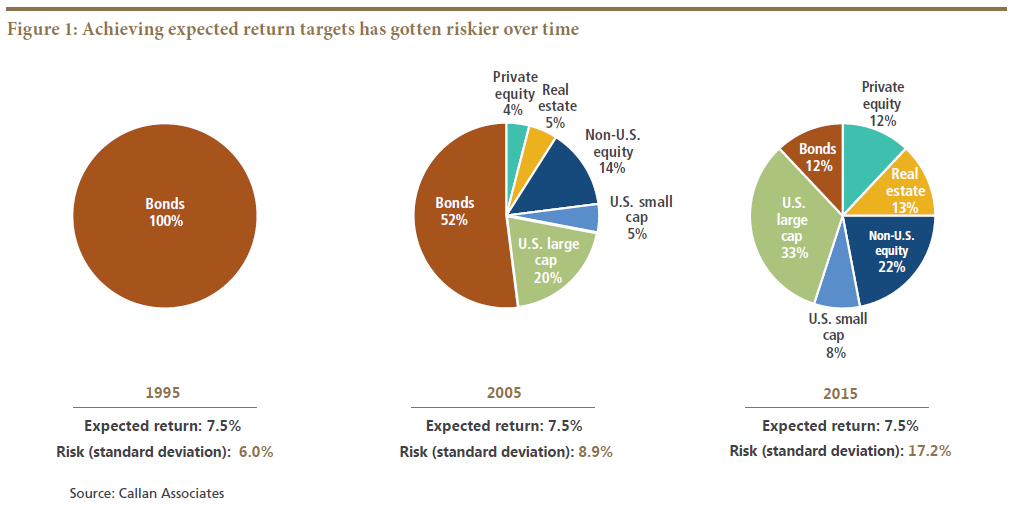

According to research by Callan Associates, lower returns expected across a variety of asset classes would require investors to take significantly higher risk today to reach the same expected returns as in the past (see Figure 1).

Most investors would find such an increase in risk undesirable, and many have already responded by trimming return expectations to some extent.

However, we believe investors should also consider non-traditional approaches and strategies with the potential to enhance returns with lower incremental risk. Among these, strategies that combine returns from two different asset classes for the same invested dollar can potentially offer a better risk/return trade-off than a blunt shift toward riskier assets – provided that the asset classes combined have a relatively low correlation. This approach – variously known as portable alpha, double value or overlays – is simpler than it sounds.

Full article at:https://www.pimco.com/insights/investment-strategies/featured-solutions/targets-and-tactics-overcoming-lower-return-expectations

No comments:

Post a Comment