It is shameful for a $100B plus corp to cheat individuals $5!!! #ShameonIntuit

TurboTax mentions a State Filing Fee of $20 but when you go to make the payment, they charge $25! I thought I was wrong so I searched online and looks like this is their standard behavior year over year!Crooked Capitalism

The world is constantly changing. When we proved that Capitalism is the best system, it is getting rotten with issues. We are slowly moving to... Purpose of this blog is to archive the articles that highlight how capitalism is changing. Secondary purpose is to connect with like minded people. If you like what I like, you are welcome to follow the blog and also share your thoughts.

Monday, April 19, 2021

Turbo Tax- How a $110 Billion Plus #CrookedCapitalism cheats individuals of $5!

Wednesday, November 25, 2020

How Walmart and Amazon take new buyers of the PLUG shares on a ride!

We believe our report is the only in-depth look at the Amazon and Walmart Transaction Agreements. We believe the revenue from these agreements has fueled the +700% rise in the stock price; however, the nature of these agreements suggests the revenue from these two customers is likely to decline in 2021.

The summary version of the Amazon and Walmart Transaction Agreements is that both companies were given warrants for up to 55.2m shares of PLUG stock in exchange for purchase orders (primarily fuel cells for warehouse forklifts) in $50m increments up to $600m total. Both companies were given warrants for 5.82m shares just for signing the agreement. At today’s stock price, this equates to a payout to Amazon and Walmart of $145m each with no strings attached. Neither party was required to purchase any products upfront, so you can see why each company took a flyer on this deal.

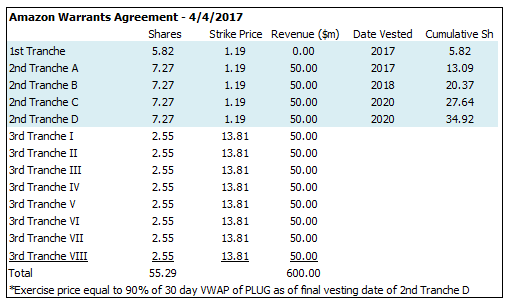

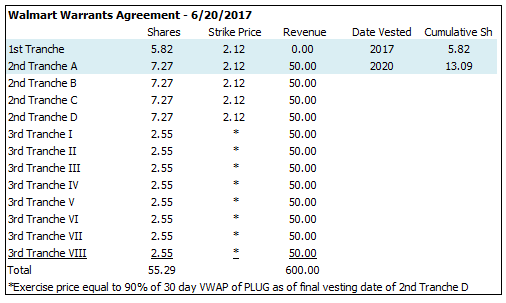

The table below shows the various tranches of warrants and the revenue level that is needed to unlock each award. The Amazon and the Walmart agreements are essentially identical with the difference being Amazon has a lower strike price than Walmart ($1.19 vs. $2.12) for the first two tranches. The tranches highlighted are those that have already been awarded.

Source: SEC filings

After signing the agreement in 2017, Amazon put in an order for $50m of PLUG products. PLUG was trading at approximately $3 per share at a time so AMZN was receiving ~$40m worth of stock in exchange for a $50m purchase order. As you can see, this is a terrible deal for PLUG shareholders with AMZN getting the PLUG products for almost nothing. Interestingly, Walmart did not place $50m worth of orders even given these generous terms for nearly three years.

These agreements with Amazon and Walmart are highly relevant because the strike prices were set so low that Amazon and Walmart stand to make more money off of the warrants than the cost of the products they have to purchase from PLUG. The higher the stock price goes, the more incentive Amazon and Walmart have to order products. For example, Walmart could unlock 7.27m shares worth $180m today by buying $50m worth of PLUG products. They could literally have the fuel cells delivered straight to a landfill and still come out $130m ahead courtesy of PLUG shareholders.

Sunday, September 27, 2020

During the worst economic downturn since the Great Depression, Jeff Bezos added $13,000,000,000 to his wealth in a single day.

Indeed, American billionaires saw their wealth increase by $434 billion during the two months between mid-March and mid-May when nearly 30 million Americans lost their jobs in the wake of the COVID-19 pandemic.

Let Bezos and Musk make billions. Just force them to share a little with the rest of us

Thursday, April 20, 2017

One more example of Crooked Capitalism: Whatever Corporations/CEOs say about H1-B/L1 visas, it is nothing but money/fat bonuses for them!

- I personally think the H1B visas program in the 2010s is nothing but a glaring example of corporate greed at the expense of the nation and the residents. This is a twisted version of Crooked Capitalism. Let me list what good will happen if Trump really curtails this program. Remember, we are no more in 1990 when the technology revolution had started with the popularization of the Internet, eCommerce, Networking, ERP systems, Java, and last but not least- Y2k fears of the meltdown of the US economy. In those years, there was a clear gap in the demand and supply of these skills. All those technologies were new and there were not enough people with the right skills. So H1B was a great solution. However, we are no more in the 1990s! We are now in 2017. I don't think H1B is as critical as Microsoft, Apple, Google, Facebook, and all big corporations want us to believe! They cry about the shortage of skills in the USA and common people would believe it. Do you know what cutting-edge technologies they use these days? Do you really believe that there are no local resources available? Maybe, 5% of what they do is cutting edge but most other stuff they do is regular DBA work, networking, routing, publishing, writing programs, maintaining and managing systems, internal business applications. Even for that 5% involved in cutting-edge technologies, I am sure, for most, the skills are available at the right price.

Do you know what has happened to people who have come on H1B over the last two decades? This program has accumulated 2 million skilled workers since then. Most of the workers who came temporarily to bridge the talent deficit have permanently settled here. IT booms have settled. IT as an industry has more or less settled down. I don't think we need to keep adding H1B forever. Current economics does not justify it. Now, I also think, it is not only citizens who are suffering due to the side effects of the H1B visa program but these early H1Bers who have made the USA their home are also at risk if H1B visa holders keep coming in. - I believe that the nexus of politicians and wall street (read as CEOs) has probably let this program over-run its useful life. They still want us to believe that the growth and innovation engine of the US economy runs on talent brought out from some struggling, poor, developing or underdeveloped countries.

THE ONLY REASON A CEO OR A CORPORATION WANTS H1B IS THAT 95% OF THE H1B VISA HOLDERS WORK AT 30-50% DISCOUNT TO CURRENT RATES. PLUS, MOST OF THESE YOUNG H1B VISA HOLDERS ARE MARRIED TO WORK! THEY WORK 20-30% MORE HOURS. This is what I see when some CEOs lobby in Washington. - When someone says US workers do not have the skill, he forgets one important thing: a 4-year college degree in the USA takes around 100k of debt ;) Unlike parents’ funding and availability of cheap education for most H1B candidates in their home countries, very few in the USA have the luxury of parents’ funding their college or willingness to assume such a large debt when you are earning $10 an hour during high school years ;)

- When they say US workers are not smart, or hardworking, they forget that these same people made this USA one of the best nations. Do you think the USA rose from dirt over two centuries by miracle? It was because of the hard work, vision, and smartness of the population. It is not a pure stroke of luck that the USA is the most prosperous and sought after country on the planet and that USD has reason from 5–6 to 67 INRs/$ ;)

- When someone says American workers are lazy, they forget to define what life means. Life is not something that is centered around money or material. Life needs to be a balance between work and family/passion/hobby. For many H1Bs/newcomers, life’s only objective/passion, in the beginning, is to get a USA green card and then Citizenship. Then, the objective is to make and save money and accumulate material/showpieces (big houses, fancy cars, and spelling bee winner kids ;) ). If some local chooses to climb mountains, or go work in peace corps or be a photographer, don’t assume he is lazy. Probably all newcomers/H1Bs want to do the same too but before that, they want to be rich ;) Many of them are trading life/time for money.

- With restrictions on H1Bs, the USA will become a better place to live. The racial divide we worry about will turn for a bit better. There is no denying that foreign YOUNG chaps are taking jobs of many middle-aged locals. More locals hate immigrant workers who have taken up their jobs than Muslims IMO.

- The economic divide between the USA and other countries, like India, will get narrower if H1B is curtailed. Most youngsters come to the USA because of the attractive currency conversion rate that makes earning in INR in the USA look very attractive. Countries like India get deprived of the benefit of some smart people who leave her for personal betterment. It is a pity many newcomers, maybe unknowingly, choose to join the rat race of money and material then following their passion, or choosing to make an impact on others. Some of them do wonders for NASA or Google in the USA but the poor in India and in the world overall is deprived of their talent.

H1B is a misused racket by US CEOs for their selfish gains. It is only a way to reduce some expenses on the income statement. Don’t take me wrong, there are some jobs for which local talent is scarce but what most of us do here can be easily found locally- the only difference is new H1Bs can mow the IT field lawns at half the price of the market rates.

(Disclaimer: I am in the USA but I was never on H1B or any work visa. Also, this article is not about you or me. It is more to highlight how Capitalism around us is getting more and more Crooked day by day!!)