We believe our report is the only in-depth look at the Amazon and Walmart Transaction Agreements. We believe the revenue from these agreements has fueled the +700% rise in the stock price; however, the nature of these agreements suggests the revenue from these two customers is likely to decline in 2021.

The summary version of the Amazon and Walmart Transaction Agreements is that both companies were given warrants for up to 55.2m shares of PLUG stock in exchange for purchase orders (primarily fuel cells for warehouse forklifts) in $50m increments up to $600m total. Both companies were given warrants for 5.82m shares just for signing the agreement. At today’s stock price, this equates to a payout to Amazon and Walmart of $145m each with no strings attached. Neither party was required to purchase any products upfront, so you can see why each company took a flyer on this deal.

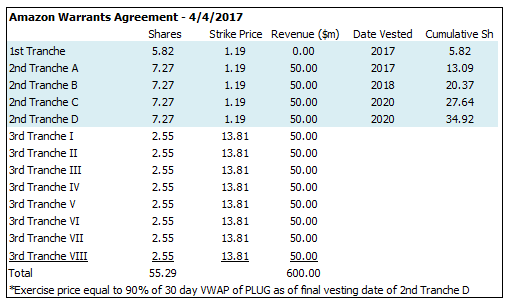

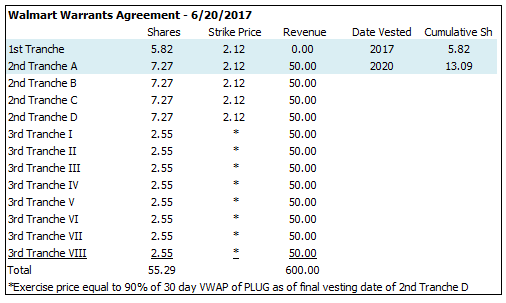

The table below shows the various tranches of warrants and the revenue level that is needed to unlock each award. The Amazon and the Walmart agreements are essentially identical with the difference being Amazon has a lower strike price than Walmart ($1.19 vs. $2.12) for the first two tranches. The tranches highlighted are those that have already been awarded.

Source: SEC filings

After signing the agreement in 2017, Amazon put in an order for $50m of PLUG products. PLUG was trading at approximately $3 per share at a time so AMZN was receiving ~$40m worth of stock in exchange for a $50m purchase order. As you can see, this is a terrible deal for PLUG shareholders with AMZN getting the PLUG products for almost nothing. Interestingly, Walmart did not place $50m worth of orders even given these generous terms for nearly three years.

These agreements with Amazon and Walmart are highly relevant because the strike prices were set so low that Amazon and Walmart stand to make more money off of the warrants than the cost of the products they have to purchase from PLUG. The higher the stock price goes, the more incentive Amazon and Walmart have to order products. For example, Walmart could unlock 7.27m shares worth $180m today by buying $50m worth of PLUG products. They could literally have the fuel cells delivered straight to a landfill and still come out $130m ahead courtesy of PLUG shareholders.

No comments:

Post a Comment